Investing For Income: Understanding Monthly Dividend Stocks

Monthly dividend stocks are a type of investment that provides shareholders with a regular income stream, distributing dividends on a monthly basis rather than the more common quarterly schedule.

Author:Finn WildeReviewer:Michael RachalJul 02, 20241.4K Shares200K Views

Monthly dividend stocks are a type of investment that provides shareholders with a regular income stream, distributing dividends on a monthly basis rather than the more common quarterly schedule.

These stocks are particularly appealing to income-focused investors because they offer more frequent payouts, which can help with budgeting and financial planning.

What Are Monthly Dividend Stocks?

Monthly dividend stocks are shares of companies that pay dividends to their shareholders every month.

These dividends are a portion of the company’s profits, distributed to investors as a reward for holding the stock.

The primary characteristic that sets monthly dividend stocks apart from their quarterly counterparts is the frequency of the payments.

While most companies distribute dividends on a quarterly basis, monthly dividend stocks provide investors with 12 payments per year, ensuring a more consistent and predictable income stream.

This regularity can be particularly beneficial for those who rely on their investments to cover living expenses or other recurring costs.

Benefits Of Monthly Dividend Stocks

#1 Regular Income Stream

This frequent payout schedule can help investors manage their cash flow more effectively, making it easier to cover monthly expenses and plan for financial needs. For retirees or those who depend on their investment income, this consistency can offer peace of mind and financial stability.

#2 Compounding Advantages

Because dividends are paid more frequently, investors have more opportunities to reinvest their earnings and purchase additional shares. This compounding process can accelerate the growth of an investment portfolio over time, leading to greater long-term returns.

#3 Flexibility In Financial Planning

With a steady stream of income arriving every month, investors can more easily align their investment returns with their financial goals and obligations. This regular income can be particularly useful for budgeting, saving for specific objectives, or reinvesting to grow one's portfolio.

Photo by Antoni Shkraba: https://www.pexels.com/photo/a-person-using-a-smartphone-5583964/

Factors To Consider When Choosing Monthly Dividend Stocks

Dividend Yield

Dividend yield is a key metric to consider when selecting monthly dividend stocks. It is calculated by dividing the annual dividend payment by the stock's current price.

A higher yield can indicate a more substantial income stream, but it's important to ensure that the yield is sustainable and not a result of a declining stock price.

Company Stability And Financial Health

Investors should prioritize companies with strong financial health and stability. This includes a solid balance sheet, consistent earnings, and a history of stable or growing revenue.

Financially robust companies are more likely to maintain and grow their dividend payments over time, providing reliable income for investors.

Payout Ratio

The payout ratio is the percentage of a company's earnings paid out as dividends. A lower payout ratio suggests that the company retains a portion of its earnings for growth and stability, which can be a sign of financial prudence.

Generally, a payout ratio below 60% is considered healthy, indicating that the company can sustain its dividend payments even during economic downturns.

Dividend Growth History

A company's history of dividend growth is another important factor. Companies that have consistently increased their dividends over time demonstrate a commitment to returning value to shareholders.

This track record can also indicate financial health and a positive outlook for future earnings growth.

Safest Monthly Dividend Stocks

The safest monthly dividend stocksare those that combine a reasonable yield with strong financial health, a manageable payout ratio, and a consistent history of dividend payments.

These stocks are typically found in sectors like real estate, utilities, and consumer staples, which tend to be more stable and less susceptible to economic volatility.

A Few Top Picks

Realty Income Corporation (O)

Realty Income Corporationis often referred to as "The Monthly Dividend Company" due to its long-standing commitment to paying monthly dividends. With a diverse portfolio of commercial properties and a solid financial foundation, Realty Income has a history of consistent dividend payments and growth.

https://www.realtyincome.com/

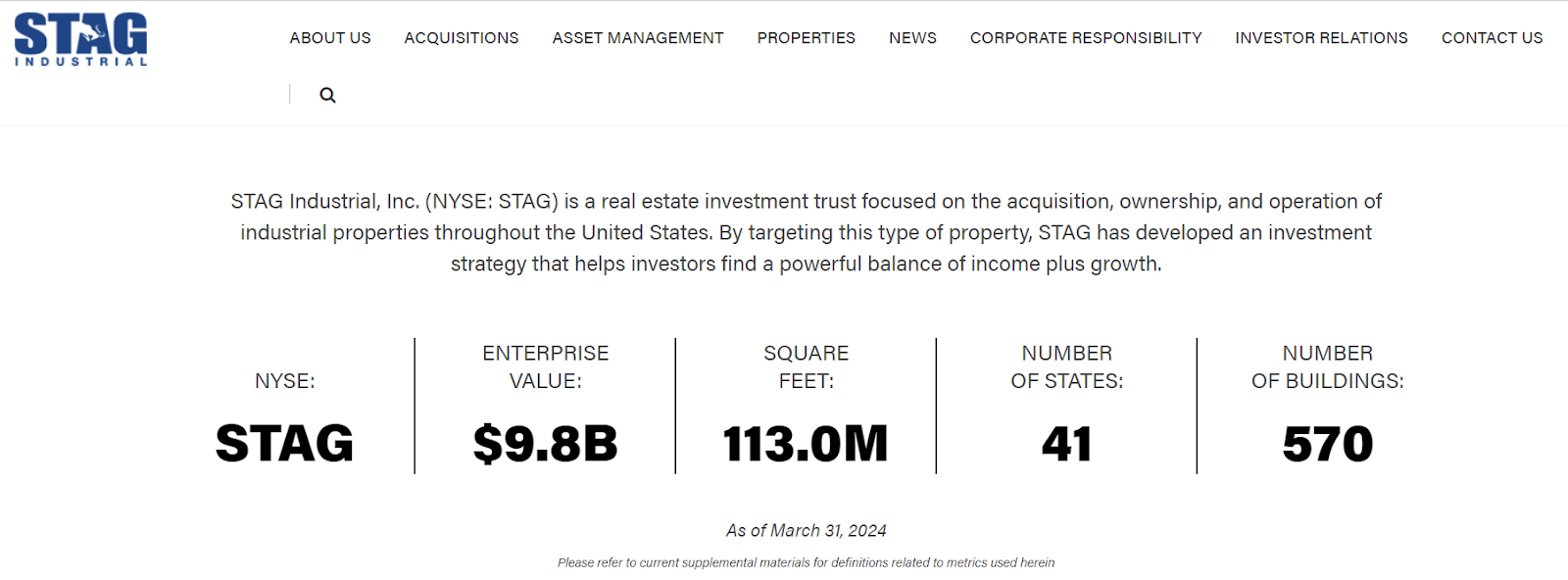

STAG Industrial, Inc. (STAG)

STAG Industrialis a real estate investment trust (REIT) that focuses on single-tenant industrial properties. The company has a stable tenant base, strong financial metrics, and a commitment to monthly dividend payments, making it a reliable choice for income-focused investors.

https://www.stagindustrial.com/

Main Street Capital Corporation (MAIN)

Main Street Capitalis a business development company that provides debt and equity financing to lower middle-market companies. MAIN offers a high dividend yield, strong financial performance, and a track record of monthly dividend payments, making it an attractive option for those seeking steady income.

https://www.mainstcapital.com/

How To Invest In Monthly Dividend Stocks

Steps To Start Investing

- Research and Selection: Begin by researching potential monthly dividend stocks, focusing on their financial health, dividend yield, and payout history.

- Open a Brokerage Account: Choose a brokerage that offers a user-friendly platform and reasonable fees. Online brokers such as Charles Schwab, Fidelity, and TD Ameritrade are popular choices.

- Purchase Stocks: Buy shares of the selected monthly dividend stocks through your brokerage account. Consider starting with a small investment and gradually increasing your holdings as you become more comfortable.

Tips For Building A Diversified Portfolio

- Diversify Across Sectors: Spread your investments across different sectors to reduce risk. This can help protect your portfolio from sector-specific downturns.

- Reinvest Dividends: Consider reinvesting your dividends to purchase additional shares, which can enhance the compounding effect and accelerate portfolio growth.

- Monitor and Adjust: Regularly review your portfolio to ensure it aligns with your financial goals and risk tolerance. Make adjustments as needed based on market conditions and company performance.

Risks And Challenges

Potential Risks Associated With Monthly Dividend Stocks

- Dividend Cuts: Companies may reduce or eliminate dividend payments during financial hardships, impacting your income stream.

- Market Volatility: Stock prices can fluctuate due to market conditions, potentially affecting the value of your investment.

- Sector-Specific Risks: Certain sectors, like real estate or energy, may be more susceptible to economic changes, affecting companies' ability to pay dividends.

Strategies To Mitigate These Risks

- Diversification: Spread your investments across multiple stocks and sectors to reduce the impact of any single stock's poor performance.

- Focus on Quality: Choose companies with strong financial health, reasonable payout ratios, and a history of stable or growing dividends.

- Stay Informed: Keep abreast of market trends, economic conditions, and company performance to make informed investment decisions.

Investing in monthly dividend stocks can provide a steady and reliable income stream, making them an attractive option for income-focused investors.

With careful selection and diversification, these stocks offer the potential for compounding growth and financial flexibility.

As with any investment, it is important to consider the associated risks and choose quality companies with strong financial health and a proven track record.

Finn Wilde

Author

For Finn Wilde, the wilderness is more than just a destination - it’s a way of life. Over the past decade, he has led multiple expeditions in some of the world’s most remote regions, from the icy fjords of Greenland to the rugged trails of Patagonia.

Finn emphasizes sustainability in all of his adventures, helping participants connect with nature while promoting responsible exploration. His expeditions inspire individuals to explore the great outdoors while fostering a deep respect for the environment.

Michael Rachal

Reviewer

Michael Rachal believes that luxury lies in the details. With over 20 years of experience in the luxury travel industry, he has crafted hundreds of bespoke itineraries for clients seeking personalized, unforgettable experiences.

Whether guiding clients through private cultural tours or curating culinary journeys with world-renowned chefs, Michael ensures that each trip is tailored to perfection.

His ability to anticipate needs and exceed expectations has earned him a reputation as a leading expert in luxury travel.

Latest Articles

Popular Articles